#stockmarket #investing #IPO #fools #beinginformed #duediligence

Unveiling the IPO Frenzy: Promoters’ Multi-Crore Overnight Triumphs

In the frantic world of initial public offerings (IPOs), there exists a mad rush fueled by extensive marketing campaigns orchestrated by the companies themselves. This carefully crafted promotion aims to entice investors into buying shares at exorbitant valuations, leading to an alarming trend. Behind the scenes, promoters eagerly await this opportunity to sell their stake, often valued at a mere fraction of the IPO price, for an astronomical sum. Overnight, these individuals can transform themselves into multi-crore (billionaire) giants, amassing enormous wealth in an astonishingly short span of time. However, beneath the allure of quick riches lies a dubious reality that begs careful examination. Is this frenzy justified, or are we witnessing a scheme where promotors exploit the IPO fever to their advantage? Exploring the true motivations and potential consequences of such phenomena is essential to gaining a clear understanding of the IPO landscape.

Decoding the P/E Ratio: Evaluating Stock Value and Growth Potential

The Price-to-Earnings (P/E) ratio is a simple metric used to evaluate the value of a company’s stock. It compares the stock price to the company’s earnings per share (EPS). A high P/E ratio indicates that investors are willing to pay more for each unit of earnings, suggesting growth potential. A low P/E ratio may indicate an undervalued stock or challenges. Investors use the P/E ratio to compare companies, identify investment opportunities, and assess risk. It helps gauge market expectations and relative stock valuation. However, it should be considered alongside other factors when making investment decisions.

In the long run, sustaining a high P/E ratio for over 10 years is exceedingly challenging. Even renowned companies like Alphabet and Apple have typically achieved P/E ratios up to 30 or higher. This indicates that the market’s optimism about a company’s future earnings growth eventually converges with its actual performance. While certain exceptional cases may temporarily maintain lofty P/E ratios, they are the exception rather than the norm. Therefore, it’s essential for investors to exercise caution when considering stocks with excessively high P/E ratios, as the market’s expectations may not always align with long-term realities.

Challenging the Myth: Sustainable Growth Rates Over 10 Years.

When we analyze a wide range of companies, a recurring pattern emerges—sustaining a growth rate of 30% or higher over a 10-year period is, in fact, a formidable challenge. Even the most renowned companies, such as Asian Paints, HDFC Bank, and Apple, have exemplified this reality. While these companies have achieved remarkable success, their growth rates have typically been lower than the lofty 30% mark. This observation debunks the notion that sustained exponential growth is easily attainable in the long run. It emphasizes the importance of realistic expectations and highlights the need for careful consideration when evaluating investment opportunities. Recognizing that sustained high growth rates are exceptions rather than the norm can lead to more informed decision-making and prudent investment strategies.

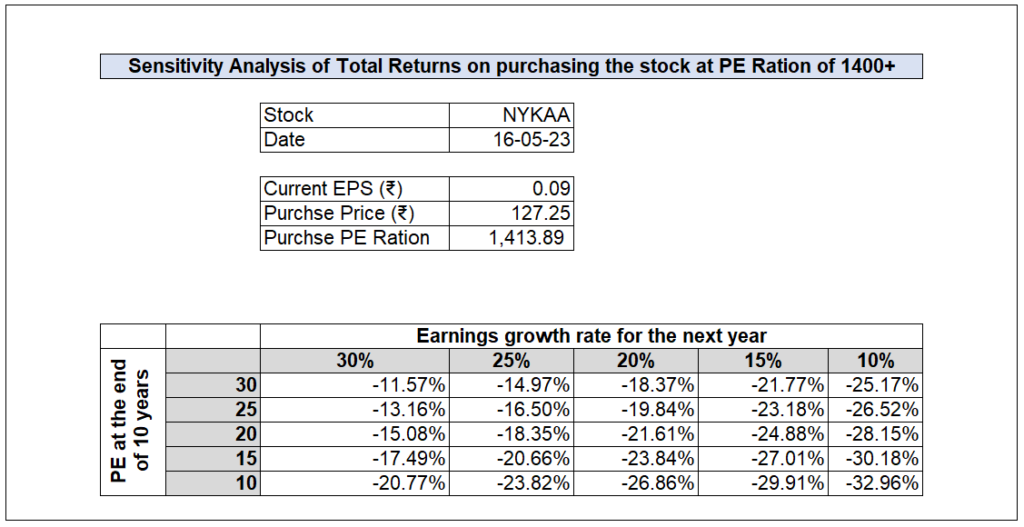

Sensitivity Analysis of NYKAA IPO: Assessing Long-Term Growth and Valuation

In an in-depth examination of the recent NYKAA IPO, it becomes apparent that a sensitivity analysis can provide valuable insights into its long-term growth potential and valuation. Assuming the best-case scenario of a 30% annual growth rate over a period of 10 years, along with an optimistic price-to-earnings (P/E) ratio of 30, one might expect the stock to trade at approximately 37 Rs. However, upon closer inspection, the current trading price of 127 Rs raises concerns about the potential loss of investment value. This stark difference underscores the importance of conducting thorough analysis before making investment decisions. The sensitivity analysis table below provides further details, shedding light on the potential outcomes and emphasizing the need for a cautious approach in assessing IPO opportunities.

Conclusion:

In summary, while short-term price variations may allow traders to profit from IPOs, long-term investors should exercise caution when investing in companies with overly optimistic valuations. As demonstrated in the case of NYKAA, the potential for substantial losses underscores the need for thorough analysis and a cautious approach. Ultimately, investing in an IPO should involve a careful evaluation of long-term growth potential and valuation to ensure that one’s money is not wasted.

Here’s the Comprehensive List of Our Blogs: Keep it Handy, Share with Friends and Family, Smash that Like Button, and Subscribe to Receive Blog Updates First. Your support fuels our passion for creating insightful content!

Disclaimer: This blog post is intended for informational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a qualified financial professional before making investment decision.