Stockbroker : Facilitating Seamless Investing and Regulatory Compliance.

A stockbroker plays a pivotal role in the world of investing, offering a range of essential services to investors. Here are the key responsibilities fulfilled by stockbrokers:

- Account Creation and Management: Stockbrokers assist investors in setting up and managing their Demat accounts, which act as secure depositories for holding stocks and other securities. They guide clients through the account creation process, ensuring a smooth and hassle-free experience.

- Trade Execution and Portfolio Management: Stockbrokers provide investors with online trading accounts, enabling them to monitor market activity, execute buy and sell orders, and manage their investment portfolios from the comfort of their homes. They execute trades on behalf of clients, ensuring prompt and accurate execution at the stock exchange while updating the holdings in the respective Demat accounts.

- Compliance with Regulatory Requirements: Stockbrokers have a crucial role in adhering to the regulatory obligations set by the government and relevant authorities. They ensure compliance with laws, rules, and guidelines laid down by regulatory bodies such as the Securities and Exchange Board of India (SEBI) in India. This includes proper documentation, record-keeping, reporting, and conducting business in a transparent and ethical manner.

- Value-Added Services and Expertise: Stockbrokers often offer value-added services to clients, including research reports, market insights, and investment recommendations. They provide expert advice based on their knowledge of the market and assist clients in making informed investment decisions. Additionally, they may offer personalized services tailored to the specific needs and goals of individual investors.

“Decoding Discount Brokers and Full-Service Brokers: Understanding Your Options in the World of Stock Trading”

in the context of brokerage services, there are discount brokers and full-service brokers, which can be compared to understand the differences:

- Discount Broker: A discount broker is a brokerage firm that offers a streamlined and cost-effective approach to trading securities. They typically charge lower commission fees or transaction costs compared to full-service brokers. Discount brokers provide essential trading services, such as order execution, account management, and access to trading platforms. However, they may offer limited research and investment advisory services.

- Full-Service Broker: A full-service broker provides a comprehensive range of services beyond order execution. In addition to facilitating trades, they offer personalized investment advice, research reports, portfolio management, and financial planning services. Full-service brokers often have dedicated advisors who work closely with clients to understand their financial goals and tailor investment strategies accordingly. As a result, they generally charge higher commission fees or fees based on a percentage of the assets under management.

The distinction between discount brokers and full-service brokers lies primarily in the level of services and the associated costs. Discount brokers prioritize cost-effectiveness and self-directed trading, while full-service brokers cater to clients seeking personalized advice and comprehensive financial services.

The emergence of Zerodha as a discounted stock broker has brought about a significant shift in the industry. Until Zerodha’s entry, discounted stock brokers were not as prevalent or popular. However, over the span of a decade, the competitive landscape evolved, compelling full-service brokers to adapt and incorporate discounted services to avoid losing market share. Recognizing the changing demands and preferences of investors, full-service brokers have recognized the need to provide cost-effective options and value propositions to remain competitive. This transformation has not only widened the choices available to investors but has also led to increased accessibility and affordability in the stock trading space. The market dynamics continue to evolve, driven by the innovative disruption initiated by discounted stock brokers like Zerodha.

Zero Brokerage Revolution: How Zerodha Empowers Long-Term Investors

Zerodha, with its zero brokerage offering, has revolutionized the landscape of stock trading, particularly for long-term investors like myself. As someone who predominantly engages in long-term holdings, the absence of brokerage charges on such trades is a game-changer. Zerodha’s no-brokerage policy for long-term investments eliminates a significant cost factor, allowing me to maximize my returns over time.

You might wonder why Zerodha exists if they don’t generate revenue from brokerage charges. The reality is that while long-term investors like me benefit from zero brokerage, there is a substantial market of individuals involved in short-term trades, intraday trading, and other similar activities. Zerodha caters to these traders and derives a significant portion of its revenue from their activities. Even though they do not charge brokerage for long-term holdings, they have a nominal annual fee in place. In fact, in 2022 alone, Zerodha generated nearly 5000Cr in revenue, showcasing the success of their business model. This is coming at time when contemporary discounted stock brokers have made 0 revenue and in fact they are running in losses .

This unique approach by Zerodha, focusing on zero brokerage for long-term investors and monetizing short-term trading activities, has allowed them to disrupt the industry while catering to the diverse needs of traders and investors. By offering a cost-effective solution for long-term investments and capitalizing on the revenue potential from frequent traders, Zerodha has positioned itself as a formidable player in the market. Their success not only showcases the viability of their business model but also highlights the changing dynamics and preferences of market participants.

Unleashing the Joy of Investing: Exploring Zerodha’s Wonderful Features for an Enriching Investment Experience

Zerodha stands out among stockbrokers for its remarkable features that have become its unique selling points (USPs), enhancing the investing experience for its clients.

Firstly, in a highly regulated market like India, it is crucial for investors to understand the charges imposed when buying or selling stocks, such as STT (Securities Transaction Tax), stamp duty, and other taxes. Zerodha simplifies this process by providing transparent and clear information about these charges, ensuring investors are well-informed.

India’s tax system can be complex, especially regarding different tax rates for intraday, short-term, and long-term trades. Zerodha excels in effortlessly calculating and displaying the tax implications of trades. This feature not only saves time and effort but also allows investors to make informed decisions about their investments. Moreover, Zerodha goes the extra mile by offering recommendations on tax loss harvesting, providing valuable insights on how investors can leverage tax losses to their advantage.

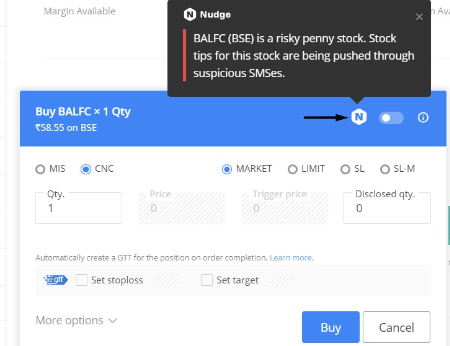

Another standout feature of Zerodha is its dedication to investor protection. They proactively alert investors if they observe suspicious pump and dump schemes associated with stocks the investor intends to purchase. This helps safeguard investors from potential fraudulent activities and enables them to make more informed investment choices.

Zerodha’s commitment to convenience is evident in its fully online account opening process. Clients can easily open an account from the comfort of their homes, eliminating the need for physical paperwork and lengthy procedures. As a testament to their seamless user experience, even tasks like updating nominations for an account become effortless and hassle-free.

Through these wonderful features, Zerodha prioritizes transparency, tax efficiency, investor protection, and convenience. By addressing crucial aspects of investing, they have succeeded in making the overall investment journey more enjoyable and empowering for their clients.

Beyond Business: The Inspiring Human Side of Zerodha’s Founders and their Commitment to Empathy

Behind the success of Zerodha lies a heartfelt story of its founders, Nithin Kamath and Nikhil Kamath. Rising from humble beginnings, these remarkable individuals have built an extraordinary company driven by passion and purpose. Despite achieving immense financial success, their down-to-earth nature remains unshaken. Following them on Twitter reveals their genuine character and unwavering dedication. Recently, their family faced the daunting battle of cancer, which served as a testament to their resilience and determination. This personal experience translated into a profound commitment to their employees’ well-being. The way they prioritize the health and welfare of their team members is an inspiration to all, emphasizing the compassionate values that define Zerodha’s culture. Beyond their achievements in business, Nithin Kamath and Nikhil Kamath exemplify the power of empathy and serve as beacons of inspiration in both professional and personal spheres.

Here’s the Comprehensive List of Our Blogs: Keep it Handy, Share with Friends and Family, Smash that Like Button, and Subscribe to Receive Blog Updates First. Your support fuels our passion for creating insightful content!

Disclaimer: This blog post is intended for informational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a qualified financial professional before making investment decision.