In a world filled with curiosity and controversy surrounding cryptocurrencies, few dare to delve into their intricacies. The complexity of this innovative digital realm often hinders understanding, leaving many hesitant to explore further. As a software and electronics engineer, I myself embarked on a challenging journey to comprehend its intricacies, and though I still have much to learn, I am eager to share my knowledge through a series of enlightening blogs. Welcome to the inaugural post, where we will begin by uncovering the genesis of cryptocurrencies and exploring the myriad advantages they bring to the table. Moreover, we will venture into the realm of traditional banking systems, unveiling the stark differences that set this groundbreaking solution apart.

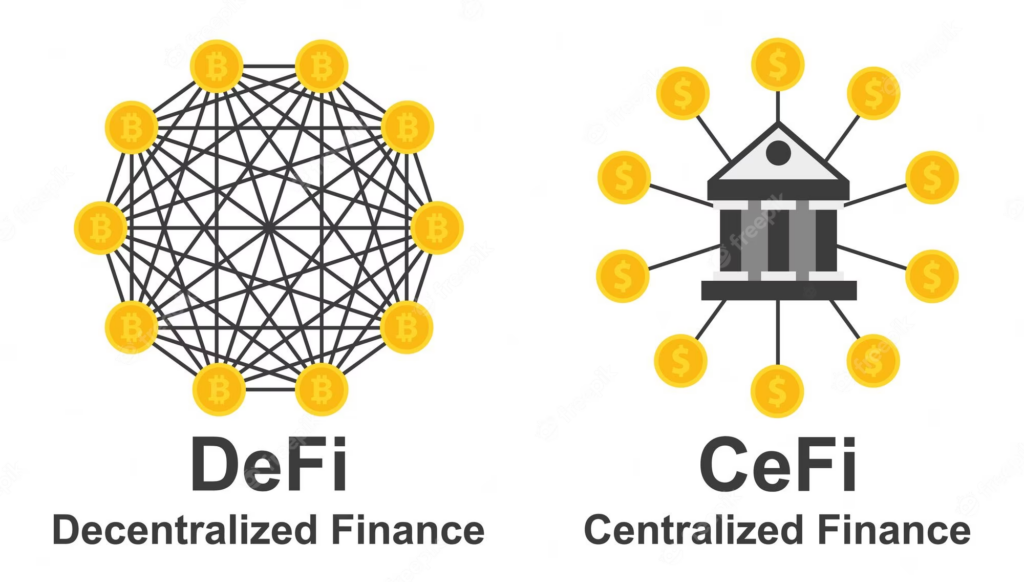

Unmasking the Pitfalls: Common Issues with Conventional Banking Systems.

Soon after the 2008 economic crash, a group of forward-thinkers dared to question the safety of traditional banks as custodians of their hard-earned money. They yearned for a financial landscape beyond the confines of banking, driven by a desire for change. Let’s uncover the common pitfalls they identified, shedding light on the problems that led them to seek alternatives to traditional banking systems.

- Banks had too much control: People felt that banks and governments had too much power over their money. They worried that this could lead to problems like censorship, freezing of accounts, or restrictions on accessing funds.

- Privacy concerns: Traditional banks often required individuals to share personal information during transactions, which invaded their privacy.

- Banks were Expensive middlemen: Using banks for transactions often involved many middlemen, like banks, payment processors, and clearinghouses, which added extra costs. This was even more evident when there were international transactions taken up by people.

- Simplified Access for everyone: Some people didn’t have access to traditional banks, especially in poorer areas.

- Security and trust: There were concerns about fraud, hacking, and data breaches in traditional banking.

- New possibilities: Cryptocurrencies opened up new ways of doing things in finance. They made it possible to create smart contracts, decentralized apps, and digital money that could change how we handle money and other financial activities.

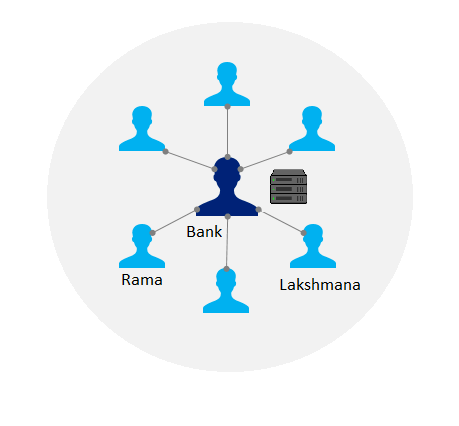

Exploring Traditional Transactions : Unveiling the Role of Banks in Conventional Financial Interactions

In this section, we will delve into the intricacies of conventional transactions facilitated by banks, shedding light on the fundamental processes involved. From initiating a transaction to its completion, we will examine the role of banks in facilitating financial interactions between individuals, uncovering the inner workings of the traditional transaction landscape.

Let’s consider a hypothetical transaction between Rama and Lakshmana as an example.

- Agreement on Transaction: Lakshmana and Rama agree on the cost of the work done, and Rama wishes to pay Lakshmana the agreed amount of Rs.100/-.

- Approach the Bank: Both Lakshmana and Rama visit the bank to initiate the transaction. They inform a bank representative about their intention to transfer funds from Rama to Lakshmana.

- Providing Information: The bank asks Lakshmana and Rama to provide the necessary information, which typically includes their account details, identification, and transaction details (such as the amount and purpose of the payment).

- Bank Server Entry: The bank representative enters the transaction details into the bank’s server. They perform three entries: deducting Rs 100/- from Rama’s account, adding the same amount to Lakshmana’s account, and deducting service fees of Rs 5/- from both accounts for the banking services rendered.

- Transaction Completion: Once the entries are made, the transaction is considered complete. The funds are transferred from Rama’s account to Lakshmana’s account, and the bank deducts service fees for facilitating the transaction.

Key Points:

- Personal Information: Banks require personal information from both parties to ensure the legitimacy of the transaction and comply with regulatory requirements.

- Bank’s Authority: Transactions in the conventional system depend on the bank’s authority and involvement. They act as intermediaries and gatekeepers in the transfer of funds.

- Service Fees: Banks charge service fees for providing their banking services, which are deducted from the involved parties’ accounts.

- Concerns: This traditional process raises concerns related to privacy, reliance on centralized authority, and the cost associated with banking services.

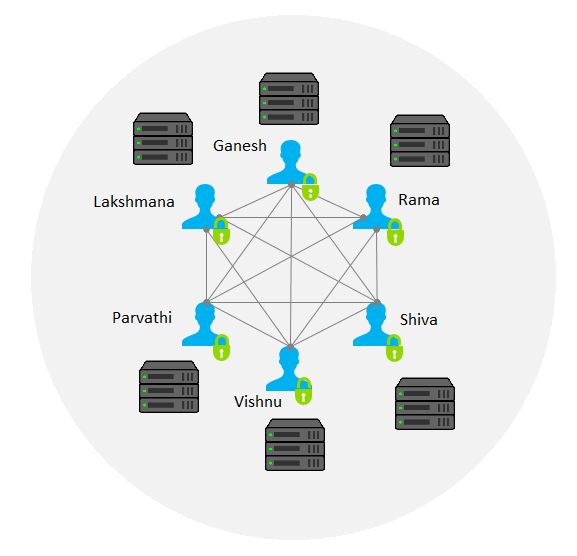

Exploring Decentralized Finance : Unveiling the technology under investigation.

Let’s consider the same hypothetical transaction between Rama and Lakshmana as an example to understand decentralized finance comparatively.

- Decentralized Network: In a decentralized finance system, each participant (Rama, Lakshmana, Ganesh, Parvathi, Vishnu, Shiva ….) has their own server connected to a network. There is no Banker essentially at the center.

- Transaction Intent: Rama, wanting to pay a specific amount Rs. 100/- to Lakshmana, publicly announces his intention to make the payment over the network. This announcement is visible to all participants.

- Transaction Acceptance: Lakshmana, in response, publicly announces his acceptance of the specified amount Rs 100/- from Rama. This acceptance is also visible to all participants in the network.

- Recording on Servers: All participants, including Rama and Lakshmana, record the transaction details on their respective servers. This creates a distributed ledger where multiple copies of the transaction record exist across different servers.

- Transaction Confirmation: The network participants validate and verify the recorded transactions using consensus mechanisms such as proof-of-work or proof-of-stake. This ensures the accuracy and integrity of the transaction history.

- Transaction Completion: Once the network reaches a consensus on the validity of the transaction, it is considered complete. The funds are effectively transferred from Rama to Lakshmana, and the transaction details are permanently recorded in the distributed ledger on each participant’s server.

Key Points:

- Decentralized Network: Participants maintain their own servers connected to a global network, eliminating the need for a centralized authority like a bank.

- Public Announcement: Transaction details are publicly announced to ensure transparency and visibility among network participants. In the real scenario there will be code names that shall be used by every customer so that the other people in the network do not know who the real person owning the account is.

- Distributed Ledger: Transactions are recorded on multiple servers, creating a distributed ledger that is resistant to single points of failure or manipulation by one single person in the node.

- Consensus Mechanism: Participants collectively verify and agree on the validity of transactions, typically through consensus algorithms, ensuring the integrity of the system.

- No Transaction fee : It shall be observed that there is no transaction fee involved in this transaction by the middleman and also it is country agnostic.

While decentralized systems offer numerous benefits, they do present challenges that need to be considered.

It is not practical for everyone to have servers at their homes like banks in order to participate in decentralized networks. The requirement for individuals to set up and maintain their own servers poses challenges in terms of technical expertise, cost, and infrastructure. Many people may lack the necessary knowledge or resources to establish and manage servers effectively.

For non-tech-savvy individuals to engage with decentralized networks, user-friendly interfaces and simplified tools need to be developed. The user experience must be intuitive and accessible, eliminating the need for deep technical understanding. However, achieving this level of usability remains an ongoing challenge.

Another concern relates to potential misuse of decentralized systems. Since transactions are publicly recorded on the network, there is a perception that it could enable illegal activities, including money laundering. While decentralized systems prioritize privacy and security, they should also adhere to regulatory frameworks and address concerns related to illicit activities. Striking a balance between privacy and compliance is crucial for widespread adoption and acceptance of decentralized finance.

The Real Mystery : Who Feed these systems with money ? What is Cryptocurrency?

In the realm of decentralized finance, a crucial question lingers: Who breathes life into this groundbreaking system by injecting money? Unlike conventional banking, where governments play a central role (Sovereign), the origins of cryptocurrencies and their initial injection into the network are shrouded in intrigue.

Stay tuned for the upcoming blog, where we’ll delve into the captivating tale of how money finds its way into this revolutionary network. Don’t miss out on this eye-opening exploration! In the meantime, make sure to like, share, and spread the word about this blog to your friends and family.

Here’s the Comprehensive List of Our Blogs: Keep it Handy, Share with Friends and Family, Smash that Like Button, and Subscribe to Receive Blog Updates First. Your support fuels our passion for creating insightful content!

Disclaimer: This blog post is intended for informational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a qualified financial professional before making investment decision.

Thank you for sharing this article with me. It helped me a lot and I love it.

I am glad you like that ! Please continue reading and sharing !