Introduction.

Saving money is a common practice aimed at achieving specific goals or planning for retirement. With numerous ways to save, individuals who prefer to avoid the complexities of analyzing direct stocks and possess a risk-averse mindset often turn to mutual funds. While some seek guidance from agents/distributors within their known community to invest in mutual funds, others with technological acumen opt for banks and apps. However, limited understanding regarding which mutual fund to choose and susceptibility to marketing tactics employed by agents or friends can hinder the potential for growth. In this blog, I aim to demystify the jargon surrounding mutual funds, provide insights into their functioning, and offer a technique on selecting the right mutual fund based on risk tolerance and desired investment duration.

Decoding Mutual Funds: Mutual Fund and a Fund Manager.

In the realm of investing, mutual funds serve as an appealing option for individuals who lack the expertise and time to make informed decisions about which stocks or debt funds to purchase. When you invest in a mutual fund, you entrust this responsibility to a skilled professional known as a fund manager. The fund manager plays a pivotal role in the mutual fund’s operation. They are tasked with carefully selecting a diverse array of stocks and debt funds to form a collection within the mutual fund. This collection could consist of hundreds of such assets, offering investors a broad portfolio of investments.

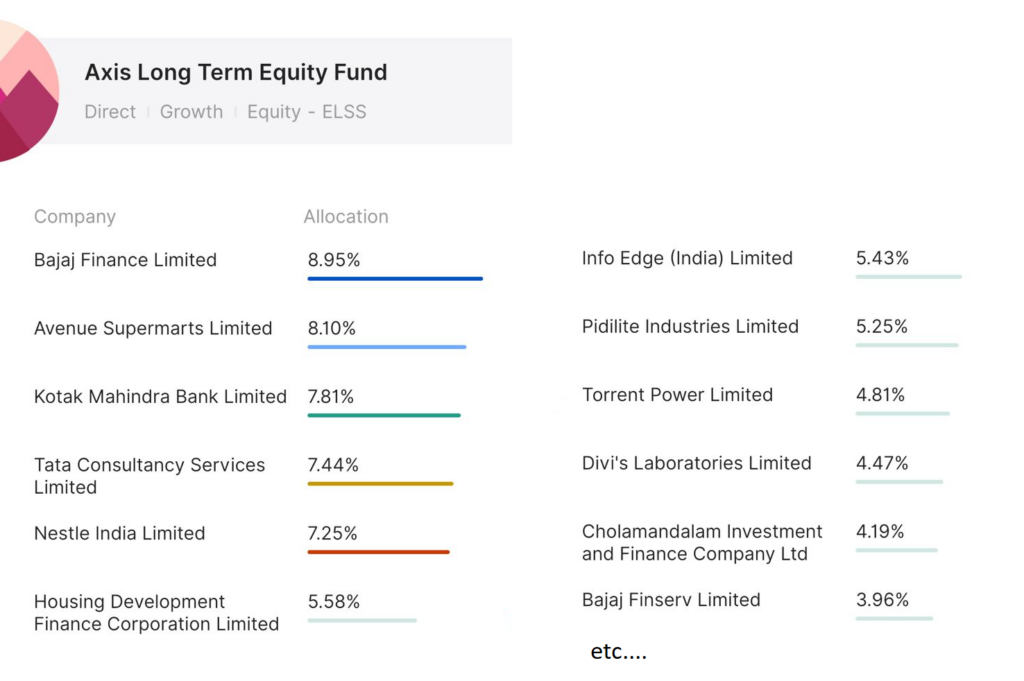

In addition to carefully selecting the stocks and debt funds to include in a mutual fund, the fund manager also determines the weightage of each asset within the fund. It’s important to understand that not all stocks are added to the fund with equal weight. The fund manager utilizes their expertise, research, and analysis to assign appropriate weightage to each asset based on various factors such as the company’s financial health, growth potential, market trends, and risk considerations.

Axis Long Term Equity Fund as example ( Not an investment Advice)- One can observe that the Fund is made up of many stocks insider and not all are of equal weightage in the fund.

The fund manager’s role doesn’t end with the initial selection of stocks and debt funds. They continuously monitor the performance of the existing assets within the mutual fund and make periodic adjustments as necessary. This could involve adding new stocks or removing underperforming ones to maintain a portfolio that aligns with the fund’s investment objectives. The fund manager’s expertise and knowledge of the market play a crucial role in ensuring the fund’s success and maximizing returns for the investors.

Inside Mutual Funds: Exploring the Roles of Fund Houses and Distributors.

Mutual Fund Houses: Powering Investment Management Mutual fund houses, also known as asset management companies (AMCs), form the core of investment management in the mutual fund industry. These entities create and manage various mutual fund schemes, employing experienced professionals such as fund managers and research analysts. They design investment strategies, select asset classes, define objectives, and ensure regulatory compliance. Mutual fund houses are responsible for shaping the overall framework and performance of the mutual funds they offer.

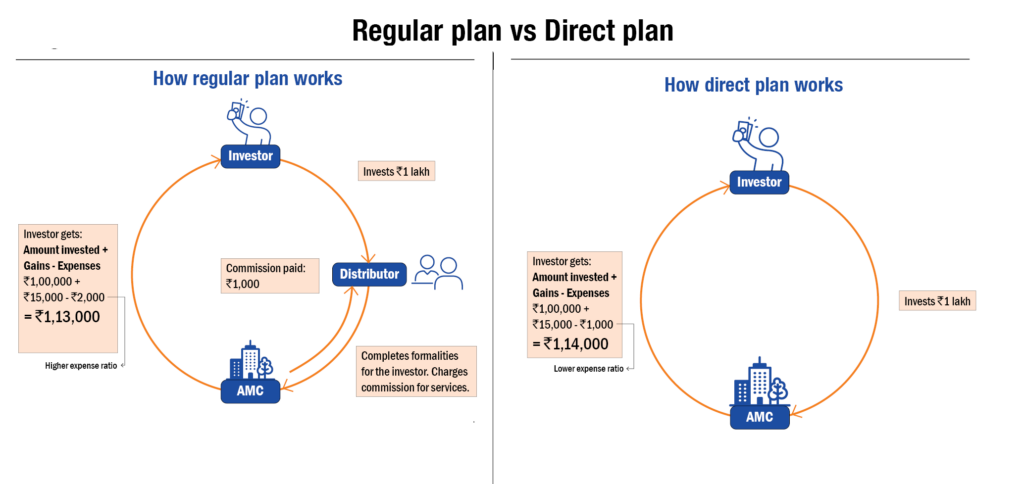

Mutual Fund Distributors: Facilitating Investment Opportunities Mutual fund distributors play a crucial role as intermediaries between mutual fund houses and individual investors. They assist investors in selecting suitable mutual fund schemes based on their financial goals, risk tolerance, and investment horizon. Distributors, which can be individuals, financial advisory firms, or financial institutions, possess in-depth knowledge of mutual funds and are certified by the regulators. They offer personalized investment advice, recommend funds, and facilitate the investment process. Investors should carefully assess the credentials and track records of mutual fund distributors to ensure reliable and knowledgeable assistance as there is personal interests that comes between.

One can certainly save a lot of money if the Distributor is removed from the equation.

Credits for the image valueresearchonline.com

Making Sense of NAVs: Understanding How Mutual Fund Values are decided and how do they Change over time.

if the funds raised for forming a securities of a mutual fund scheme is ₹200 lakh and the mutual fund plans to issued 10 lakh units of ₹ 10 each to the investors, then the NAV per unit of the fund is ₹ 20 (i.e., ₹200 lakh/10 lakh) at the time of formation.

Over time, as the value of the underlying stocks or securities bought at the time of formation and held by a mutual fund changes, the Net Asset Value (NAV) of the fund also fluctuates. In simpler terms, as the individual stocks or securities within the fund increase or decrease in value, it directly affects the overall value of the mutual fund.

Net Asset Value (NAV) is a key concept in mutual funds that represents the per-unit value of the fund. It tells you how much each unit of the mutual fund is worth. NAV is calculated by dividing the total value of the fund’s assets (like stocks and bonds) minus any liabilities (such as expenses or debts) by the total number of units held by investors. For example, if a mutual fund has Rs 10 million worth of assets and there are one million units outstanding, the NAV would be Rs10 per unit ($10 million / 1 million units).

The NAV of a mutual fund can change over time due to various reasons. One of the main factors is the performance of the investments held within the fund. Let’s say a mutual fund primarily holds stocks, and the value of those stocks increases. As a result, the total value of the fund’s assets goes up, leading to a higher NAV. For instance, if the NAV was Rs 10 per unit and the stocks performed well, increasing the fund’s total value to Rs 12 million, the new NAV would be Rs 12 per unit (Rs 12 million / 1 million units). On the other hand, if the stocks decline in value, the total value of the fund decreases, leading to a lower NAV.

Understanding Different Types of Mutual Funds: A Comparative Analysis of Equity, Debt, Hybrid, Index Funds, Large Cap Funds, and Small Cap Funds

Mutual funds come in various types, each catering to different investment objectives and risk preferences. Let’s explore some of the common types of mutual funds and their advantages in terms of risk, returns, and fees.

- Equity Funds: Equity funds primarily invest in stocks, aiming for long-term capital appreciation. They offer the potential for higher returns but also come with higher risk due to market volatility. These funds suit investors with a higher risk appetite and a longer investment horizon.

- Debt Funds: Debt funds invest in fixed-income securities like government bonds, corporate bonds, and money market instruments. They aim to generate stable income and are considered relatively lower risk compared to equity funds. Debt funds are suitable for conservative investors seeking regular income and capital preservation.

- Hybrid Funds: Hybrid funds, also known as balanced funds, combine equity and debt investments in varying proportions. They offer a balanced approach, seeking capital appreciation along with income generation. Hybrid funds provide a middle ground between equity and debt funds, appealing to investors looking for a mix of growth potential and risk mitigation.

| Mutual Fund Type | Features | Pros | Cons |

|---|---|---|---|

| Equity Funds | – Invest in stocks | – Potential for high returns | – Higher risk and market volatility |

| Debt Funds | – Invest in fixed-income securities (bonds) | – Lower risk and stability | – Generally lower returns compared to equity funds |

| Hybrid Funds | – Combine equity and debt investments | – Balanced approach, growth potential and income generation | – Moderate risk and returns, may not suit extreme risk preferences |

Additionally, there are specific types of mutual funds( Under Equity Funds) that focus on particular market segments or investment strategies. For example:

- Index Funds: Index funds aim to replicate the performance of a specific market index, such as the NIFTY50. They offer broad market exposure and lower expense ratios compared to actively managed funds. Index funds are suitable for investors seeking market returns with lower fees.

- Large Cap Funds: Large cap funds invest in well-established companies with large market capitalization. These funds tend to be more stable, making them suitable for conservative investors seeking growth potential with reduced risk.

- Small Cap Funds: Small cap funds invest in smaller companies with higher growth potential but higher risk. They are suitable for investors with a higher risk appetite and a longer investment horizon, as these companies have greater growth prospects but may be more volatile.

It’s important to assess your risk tolerance, investment goals, and time horizon when selecting a mutual fund. Diversifying your investments across different types of mutual funds can help achieve a balanced portfolio that aligns with your financial objectives. More details of this selection part in Part 2 of this blog.

Navigating Mutual Fund Charges: Understanding Exit Loads, Expense Ratios, and Distributor Commissions.

Investing in mutual funds involves various charges that investors should be aware of. These charges include expense ratios and exit load.

Understanding these charges is crucial for investors to make informed decisions. It’s recommended to thoroughly review the mutual fund’s prospectus and other relevant documents to gain clarity on the specific charges associated with a particular fund. Being aware of these charges helps investors assess the overall cost-effectiveness and potential impact on investment returns.

Expense Ratio: The expense ratio represents the annual fee charged by the mutual fund house to cover the operating expenses of managing the fund. It includes costs such as fund management fees, administrative expenses, marketing expenses, and custodian fees. The expense ratio is expressed as a percentage of the fund’s average net assets. It is deducted from the fund’s assets, thereby reducing the returns received by investors. It’s important to compare the expense ratios of different mutual funds to understand the impact on overall returns.

Exit Load: An exit load is a fee charged by mutual funds when investors redeem or sell their mutual fund units within a specific period. The purpose of the exit load is to discourage short-term trading and promote long-term investing. The charge is usually a percentage of the redeemed amount and varies across different mutual funds. Investors should carefully consider the exit load before making any premature withdrawals to avoid incurring additional costs.

Regulating Mutual Funds in India: Roles and Responsibilities of Regulatory Bodies.

Mutual funds in India are regulated by the Securities and Exchange Board of India (SEBI), which is the primary regulatory body overseeing the securities market in the country. SEBI plays a crucial role in ensuring investor protection, maintaining market integrity, and promoting the growth and development of the mutual fund industry. Here are the key roles and responsibilities of SEBI in regulating mutual funds:

- Framing Regulations: SEBI formulates regulations, guidelines, and codes of conduct for mutual funds to ensure compliance with industry standards.

- Approval Granting: SEBI grants approval to mutual fund houses for establishing and operating mutual fund schemes in India, evaluating their credentials and capabilities.

- Monitoring and Supervision: SEBI continuously monitors mutual fund activities, conducts inspections and inquiries to detect non-compliance, and takes necessary actions to protect investor interests.

- Investor Protection: SEBI safeguards the interests of mutual fund investors by ensuring accurate and transparent information, promoting disclosure requirements, and enhancing investor education and awareness.

- Industry Standards Enhancement: SEBI works to enhance standards and practices in the mutual fund industry, encouraging best practices in fund management, fostering innovation, and facilitating the resolution of investor grievances.

SEBI’s robust regulatory framework and oversight contribute to the overall stability and credibility of the mutual fund industry in India, instilling confidence among investors and fostering long-term growth.

Conclusion:

In conclusion, this blog has provided an introduction to mutual funds, explaining the roles of fund managers, the concept of NAV, different types of mutual funds, and the charges involved. We have also discussed the regulatory role of SEBI in India. While this blog covered important aspects of mutual funds, there is more to explore in terms of selecting the right funds, making purchases, and monitoring investments. In the upcoming Part 2, we will delve into the process of selecting mutual funds, making informed decisions, and effectively tracking their performance. Stay tuned for practical tips and insights to help you navigate the world of mutual funds. Until then, take care and happy investing!

Here’s the Comprehensive List of Our Blogs: Keep it Handy, Share with Friends and Family, Smash that Like Button, and Subscribe to Receive Blog Updates First. Your support fuels our passion for creating insightful content!

Disclaimer: This blog post is intended for informational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a qualified financial professional before making investment decision.

This is a great post. It’s very engaging and well organized. I’ll come back from time to time for more posts like this one.