Introduction:

In this blog, I share my journey of rational investment and how I consistently selected the right investment vehicles to achieve my financial goals. Starting at the age of 12, I learned the value of saving and progressed from fixed deposits to purchasing items like a cycle and computer. Later, I began planning for retirement after the birth of my child. Although I don’t invest in mutual funds personally, I recognize their potential and explain how I approach savings and the considerations to choose the right mutual fund vehicle for specific goals.

Remember, each person’s financial circumstances and goals are unique. Therefore, it’s crucial to conduct thorough research and seek tailored professional guidance. Before diving into investment strategies, ensure you have adequate health insurance and term insurances to safeguard your financial stability. Join me on this enlightening exploration of rational investment as we delve into choosing the right investment vehicle and the thought process behind it.

To effectively achieve my financial goals, I prefer categorizing them into short term, medium term, and long term. This classification allows me to adopt different approaches for each category, ensuring a balanced and strategic investment plan. By clustering my goals in this manner, I can focus on specific timeframes and tailor my investment strategies accordingly. In the following sections, we will explore each category in detail and examine the approaches I employ to achieve success in each. From short term objectives that require liquidity and quick returns, to medium term goals that involve moderate risk and growth potential, and finally, long term aspirations that prioritize wealth accumulation and retirement planning, this holistic approach enables me to optimize my investments and realize my financial ambitions.

I recommend reading this blog before you continuing if not done already – Link

Securing Short-Term Goals: The Power of Debt Mutual Funds and Fixed Deposits.

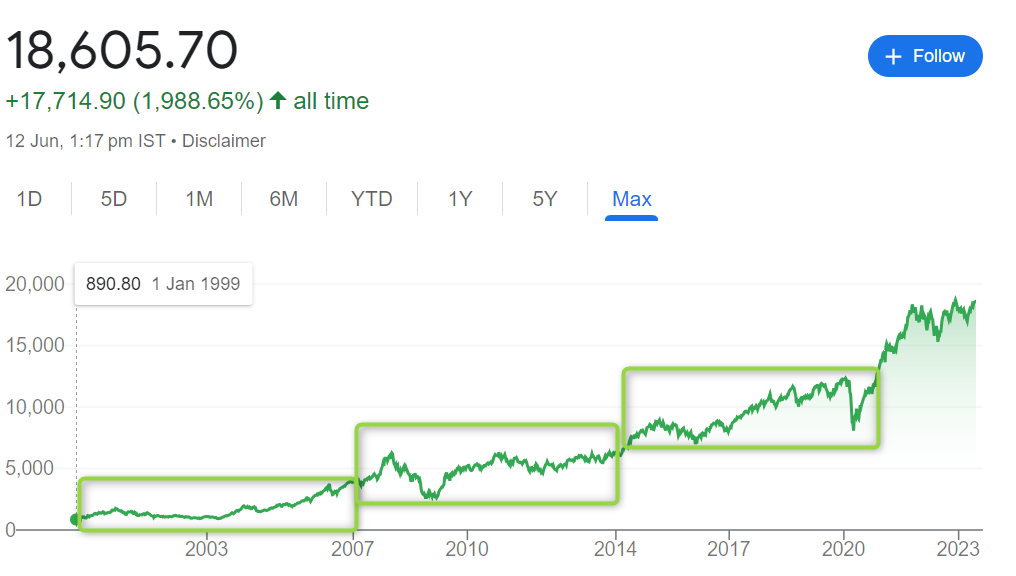

Let’s consider the example of NIFTY50 to evaluate whether the stock market or equity investments are suitable for short-term investments. Upon examining the chart below, we can observe that there are significant inconsistencies in the returns over different two-year periods. Some two-year blocks have yielded positive returns, while others have resulted in negative returns.

By analyzing the historical performance of NIFTY50, it becomes evident that the stock market can be volatile and unpredictable over short timeframes. The fluctuating nature of stock prices makes it challenging to accurately predict short-term outcomes. While there have been periods of positive returns, there have also been instances where investments in the stock market have led to losses within a two-year period.

When it comes to short-term goals with a specific timeframe of 2-3 years, such as buying a MacBook, purchasing a DSLR camera, or going on a Euro trip, the financial objective is clear and the required amount of money is known. In this case, buying stocks / mutual funds that have exposure to stocks ( equity) may not be the most suitable option due to the uncertainty of returns within such a short timeframe. Instead, two viable options for achieving these short-term goals are investing in a debt-focused mutual fund or opting for Fixed Deposits.

Debt-focused mutual funds provide an attractive alternative, offering full exposure to debt instruments while minimizing or completely avoiding exposure to equity. These funds invest in fixed-income securities like government bonds and corporate bonds, which provide a regular stream of income and potentially stable returns. By selecting a mutual fund that aligns with your risk tolerance and investment horizon, you can effectively accumulate the necessary funds for your short-term goals.

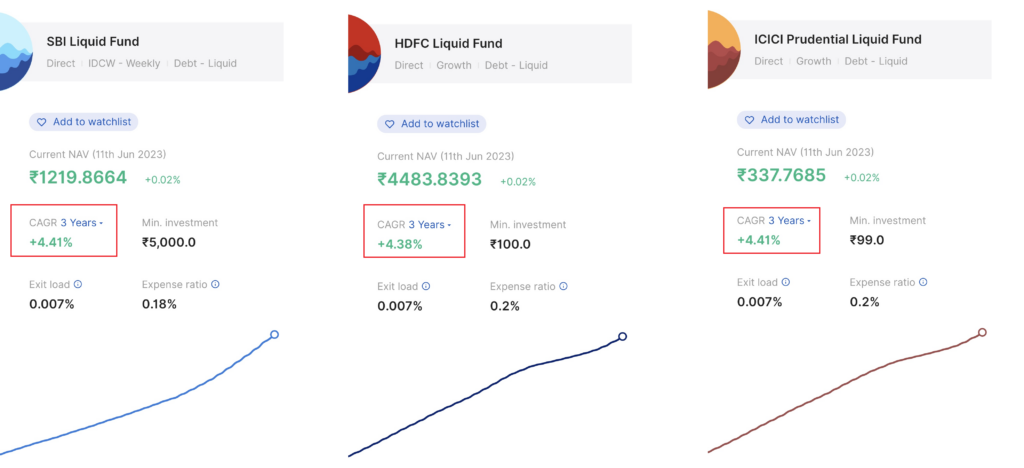

Typical Mutual Funds in the short run have roughly given 4-4.5% returns in the past 3 years as on today and the chances of this repeating for the next 3 years is higher !

Fixed Deposits is another option for short term investing , which provide a secure and predictable way to grow your savings. By depositing a specific amount for a predetermined period, you earn a fixed interest rate. Fixed Deposits offer stability and ensure that your money will be available when you need it to fulfill your short-term aspirations.

Typical Fixed deposits as on today are offering 7.0-7.5% returns over the next 3 years and seems more attractive over debt funds .

“Currently”, I find Fixed Deposits more appealing than debt mutual funds for my short-term needs. However, it is important to recognize that circumstances can change over time. When making investment decisions, I will assess the prevailing situation and adapt my strategy accordingly. By continuously evaluating and adjusting my approach, I can ensure that my investments align with the evolving market conditions and my specific financial goals. Flexibility and adaptability are key when navigating the dynamic nature of the investment landscape.

Balancing Risk and Reward: The Case for Equity Mutual Funds in Achieving 5-7 Year Goals.

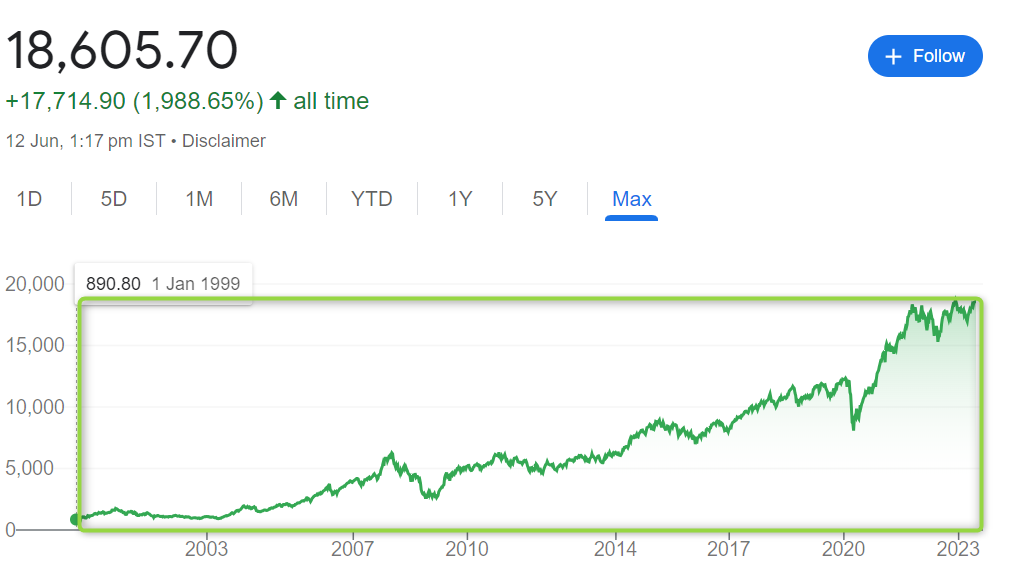

Let’s consider the example of NIFTY50 again to evaluate whether the stock market or equity investments are suitable for medium-term investments. Upon examining the chart below, we can observe that there are significant consistencies in the returns over different seven-year periods. all of them have got positive returns, may be at different rates but are in general positive .

It is more or less clear that equity is a great option for mid term investing but the problem doesn’t end here , this is just opening up a new bunch of problems

There are wide range of Mutual funds that are exposed to equity are available in the market today ,The options range from index funds to small-cap, large-cap, mid-cap, and hybrid funds.

While I understand the confusions that arise, based on my rationale, I would prefer to refer to the following table for guidance.

| Flexibility of Goal | Recommended Product | Rational |

|---|---|---|

| Not Flexible | Hybrid Funds | Risk is lesser, so are the rewards due to exposure to debt instruments |

| Slightly Flexible | Aggressive Hybrid Funds | Slightly higher risk, with slightly lower returns due to the presence of debt |

| Flexible | Index Funds / Equity Funds | Slightly higher risk, but higher returns as they have 100% exposure to equity |

| Extremely Flexible | Mid Cap / Small Cap Funds | High risk and potentially high rewards due to exposure to mid/small-cap stocks |

Building Wealth for Retirement: Why Equity is Key to Long-Term Savings.

Let’s consider the example of NIFTY50 again to evaluate whether the stock market or equity investments are suitable for long-term investments. Upon examining the chart below, we can observe that in the long run stock market / equity gives real good returns , it is in-fact the same in any developing countries.

A recommended strategy for long-term savings is to begin investing in a combination of small-cap and index funds early in one’s career. Allocating funds equally between these two categories allows for growth potential and broad market exposure. As individuals approach retirement, gradually shifting the allocation towards index funds provides stability. Upon retirement, it is advisable to consider moving the portfolio into risk-free options like fixed deposits or debt funds to preserve capital. This strategy should be personalized based on individual circumstances and regularly reviewed with a financial advisor.

Selecting the Right Mutual Fund: Unveiling the Rational Behind Fund House and Manager Evaluation.

When it comes to choosing the right mutual fund, considering the track record of the fund house and the expertise of the fund manager becomes crucial. Investors should conduct thorough research on the fund house’s reputation, stability, and financial performance. Exploring online resources ( googling ) and financial news platforms can provide valuable insights into the fund house’s history, any reported fraud cases, and overall credibility.

Additionally, evaluating the specific mutual funds offered by the fund house requires assessing factors such as entry costs, exit loads, and expense ratios. Comparing these costs among different funds can help investors make an informed decision that aligns with their financial goals and risk tolerance. It’s important to note that investment decisions should not solely rely on past performance but should be combined with an understanding of the fund’s investment strategy and objectives.

Once invested, staying vigilant is essential. Investors should regularly check for any newsletters or updates shared by the fund house, as these communications often provide insights into market trends, fund performance, and any changes in the investment strategy. Additionally, keeping an eye on financial news and reports about any fraud or controversy related to the fund house can help investors stay informed and take necessary actions if required.

Conclusion :

In conclusion, comprehending the suitability of investment vehicles for short, medium, and long-term goals is crucial. For short-term objectives, fixed deposits and debt mutual funds offer stability. Medium-term goals benefit from a combination of small-cap and index funds. For long-term aspirations like retirement, equity investments provide growth potential. Thorough research on fund houses and managers, evaluating past performance, costs, and staying informed through newsletters and news sources are essential practices. Seek professional advice and adapt strategies as needed. Empower yourself with knowledge and diligence to navigate the complex world of investments and work towards financial success.

This is a good Place to start ones mutual fund’s journey I believe : Coin by Zerodha.

Want to learn why I choose direct equity investment over mutual funds? – A new post discussing this topic will be published soon, please follow my blog page.

Here’s the Comprehensive List of Our Blogs: Keep it Handy, Share with Friends and Family, Smash that Like Button, and Subscribe to Receive Blog Updates First. Your support fuels our passion for creating insightful content!

Disclaimer: This blog post is intended for informational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a qualified financial professional before making investment decision.

I enjoyed reading your piece and it provided me with a lot of value.

I am happy to know about this 🙂 Do continue to read the articles , share it with people who are in need of information .

Your insights on mindfulness are a game-changer! Your practical tips have made a noticeable difference in my daily life. Grateful for your wisdom.