In the early days of my career, I realized something important. I learned that if you just keep your money sitting around doing nothing, it loses value over time because prices go up (that’s called inflation). So, instead of keeping a lot of cash or easily accessible money, I decided to use most of my money by investing it. I put it into things that can grow in value and make me more money, in addition to what I earn from my job.

In my upcoming blog post, I want to share what I’ve learned over the years about inflation, how to protect your money, and how to make it work for you. It’s all about making your money grow and securing a better financial future. I’ll explain it all in simple terms, so it’s easy to understand and apply to your own life.

Unlocking Inflation: Beyond Single-Item Price Hikes to Understand Your True Purchasing Power.

To truly grasp the impact of inflation, we can’t rely on the price increase of a single item. Consider this: ten years ago, a refreshing tender coconut cost you just 20Rs, and today it’s 50Rs – a 2.5-fold increase. If you thought 100Rs in 2013 should now be worth 40Rs, you’d be mistaken. That’s because not all goods and services inflate at the same rate. For instance, while photocopying 10 sheets used to cost 8Rs back then, it’s only 10Rs today.

To gain a more accurate understanding of how inflation affects your life, look beyond individual items. Instead, assess how much you spent on your overall cost of living in 2013 compared to today. If your lifestyle hasn’t drastically changed, this can provide a clearer picture. For example, if you were spending 30,000Rs per month in 2013 for the same standard of living that now costs you 60,000Rs per month, it indicates that the value of the Rupee has effectively halved in the past decade.

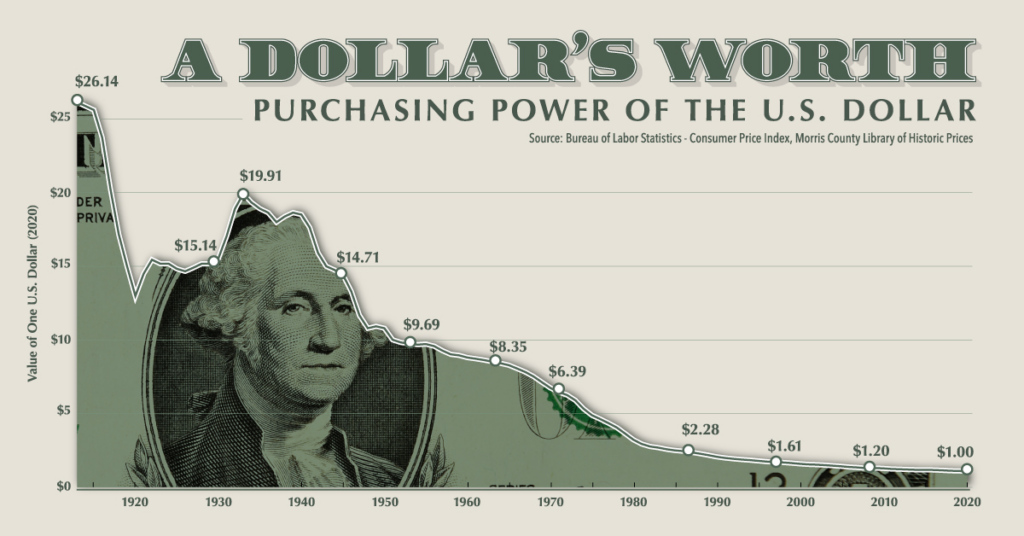

And if you haven’t meticulously tracked your expenses, you can turn to government data, like the Consumer Price Inflation (CPI), which illustrates how the Rupee’s purchasing power diminishes year by year. This broader perspective offers a more meaningful insight into the erosion of your purchasing power over time due to inflation.

This is not specific to India but a generic concern across the glob , For instance have a look at how the USD has lost its purchasing power over a century.

Cash is indeed an asset, but it loses value over time due to inflation. – This raises important questions:

- Should I keep any cash on hand? -If so, how much cash should I keep?

- What alternatives can safeguard our money from inflation?

- Can our investments generate returns exceeding inflation to build wealth?

Balancing Liquidity: How Much Cash do I Keep?

When addressing the questions of whether to keep any cash on hand and how much, it’s crucial to differentiate between liquid and non-liquid assets. Liquid assets, such as cash, gold (not ornaments), and certain online-accessible fixed deposits, are those that can be easily converted into cash with minimal loss of value. Non-liquid assets, on the other hand, include investments like real estate, stocks, or long-term bonds, which can’t be quickly converted to cash without potential financial loss.

For me, ensuring a cash reserve covering two months’ worth of living expenses falls under Cash category. Additionally, I allocate an amount equal to my anticipated expenses over the next two years in the form of liquid assets. The remainder of my wealth is then strategically invested in these non-liquid assets, aiming to generate returns that surpass inflation.

Converting money to Gold / Fixed Deposits give you some returns like 3-4% which might not cover the inflation fully which is normally at 6% in India but protects your money to some extent.

Inflation-Proofing Your Finances: Strategies and Investments.

When it comes to protecting your money from the erosive effects of inflation, there are several strategies to consider. First and foremost, I believe that the most valuable investment one can make is in themselves. This entails continuous learning, acquiring new skills, and staying updated with the ever-evolving opportunities that the world offers. Pursuing certifications, participating in educational courses, devouring books, and applying newfound knowledge through experimentation has been a cornerstone of my financial journey.

Following personal growth, I delve into the world of stocks. Extensive research into listed businesses, meticulous analysis of annual reports, scrutiny of financial statements, and summaries of conference calls are essential steps. I seek companies with strong long-term potential, backed by a robust track record, and hold onto these investments for extended periods. However, for those less experienced or inclined toward active stock market participation, mutual funds present a convenient option. With a skilled fund manager overseeing the portfolio, they provide exposure to diversified investments, albeit with a management fee.

Another avenue worth exploring is real estate, though it’s one I have personally refrained from due to limited digitization in transactions and concerns about fraudulent activities. Nonetheless, real estate can be a valuable non-liquid asset for those who understand the intricacies of the market. Historically, real estate has generally kept pace with inflation, and in some instances, even outperformed it, as attested by those deeply involved in the real estate sector.

The Road to Wealth: Unconventional Investments in an Inflationary World.

When it comes to surpassing inflation and building wealth through investments, the landscape has evolved beyond traditional options. Beyond stocks and real estate, today’s investors have an array of choices, from cryptocurrencies to art and diamonds. Some of these alternative investments have not only shielded against the erosion of the Rupee’s value due to inflation but have outperformed it significantly, boasting annual returns ranging from 20% to a staggering 80%. However, it’s crucial to delve into the ‘why’ behind these investments’ meteoric rise and assess whether they will continue to appreciate in the long term. As the adage goes, “High-risk, high-return,” but it’s equally important to remember that the odds of achieving those returns can be slim.

Here’s the Comprehensive List of Our Blogs: Keep it Handy, Share with Friends and Family, Smash that Like Button, and Subscribe to Receive Blog Updates First. Your support fuels our passion for creating insightful content!

Disclaimer: This blog post is intended for informational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a qualified financial professional before making investment decision.