What is NPS(National Pension Scheme) ?

In contrast to developed nations offering “Social Security” programs, India lacks a similar comprehensive support system for its citizens. The absence of such a safety net leaves individuals vulnerable to financial instability during retirement, sudden unemployment, disability, or loss of a spouse or parent. To address this gap, India introduced the National Pension Scheme (NPS) following the discontinuation of the old pension scheme. NPS aims to partially fulfill this role by encouraging individuals to save regularly, with contributions invested in a mix of equities, corporate bonds, and government bonds to generate returns that can safeguard their retirement years.

To be eligible for the National Pension System (NPS), you must:

- Be an Indian citizen, either a resident, non-resident, or Overseas Citizen of India (OCI).

- Be between 18 and 70 years old as of the application date.

- Comply with the Know Your Customer (KYC) norms in the application form.

- Be legally able to sign a contract under the Indian Contract Act.

- Not already have an NPS account.

- Work in a corporate that has adopted the NPS scheme.

What is the Minimum Amount one should invest in NPS & is there any Maximum Limit ?

The minimum initial contribution to the National Pension Scheme (NPS) is Rs 500. You must make these contributions when you register, and you must contribute at least once a year, with a minimum contribution of Rs 1,000. There is no Maximum limit on the NPS maximum contribution per year, any investment above 2Lakhs threshold will not be eligible for tax deductions.

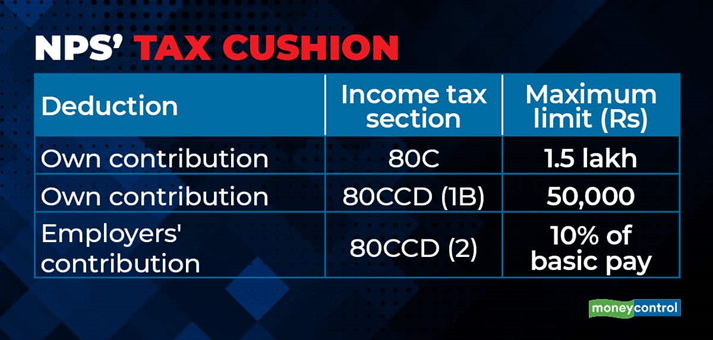

A tax exemption of Rs. 1.5 lakh can be claimed on the employee’s and employer’s contribution towards the National Pension System (NPS). Tax benefits can be claimed under Section 80CCD(1), 80CCD(2), and 80CCD(1B) of the Income Tax Act.

Where will my money be invested & how is the historic returns looking like ?

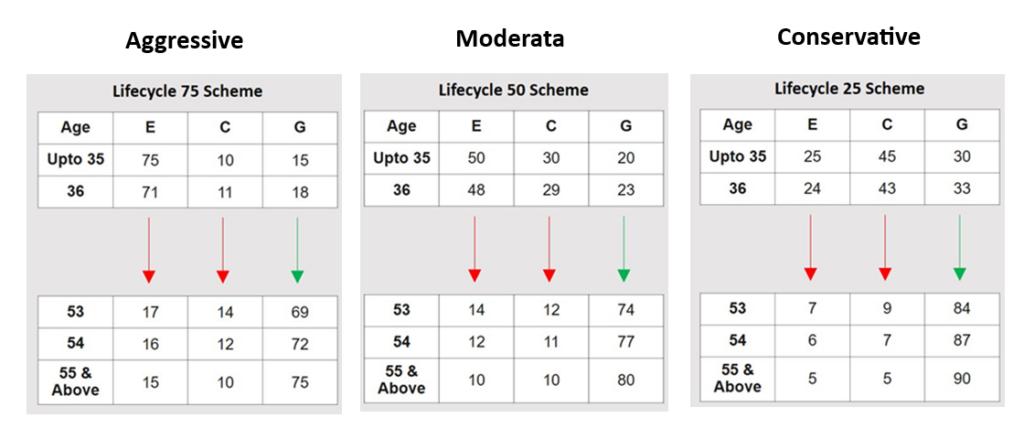

In NPS, you have the option to choose how your money is invested in different asset classes. These are known as ECG in NPS – Equity (E), Corporate Debt (C), Government Securities (G), and Alternative Investment Funds (A).

Equity can be thought of as buying stocks, Corporate Debt as similar to fixed deposits in private banks, and Government Securities as akin to purchasing Kisan Vikas Patra or National Saving Certificates from the Post Office. While Equity involves higher risk with potentially higher returns, Government Securities carry lower risks and offer modest returns that may just surpass inflation.

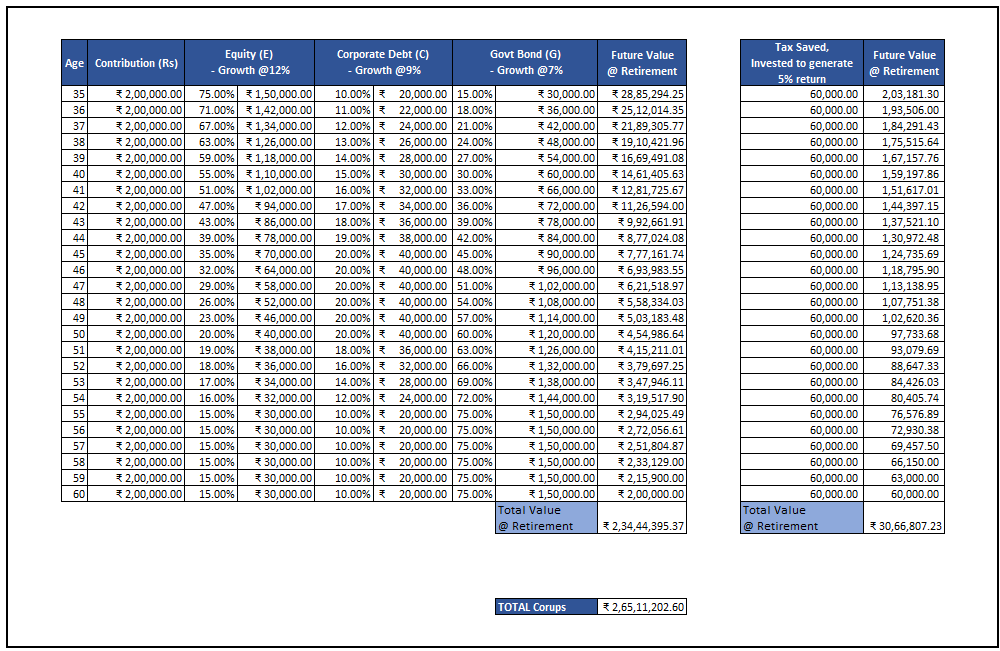

Even for those inclined towards risk-taking, there are restrictions on the extent of Equity exposure permitted. The most aggressive choice allows for a maximum Equity exposure of 75% at the age of 35, gradually decreasing to 15% beyond 55 years of age.

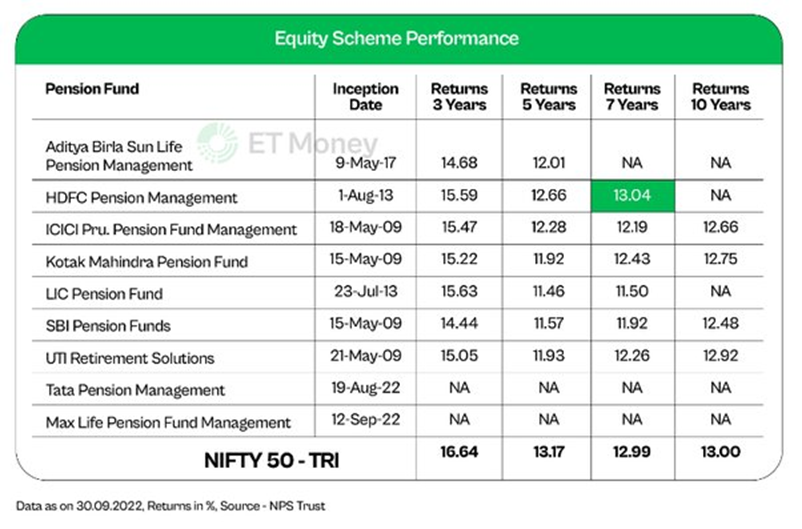

How are the returns looking like in Equity for NPS ?

Although one gets an exposure to Equity , the catch is one cannot go pick the stock , it has to be done by a Pension Fund which one has opted for , they could invest in Index stocks or the Index funds itself. Data published by NPS Trust reveals that on a long term horizon Equity schemes have provided returns around 12% at max.

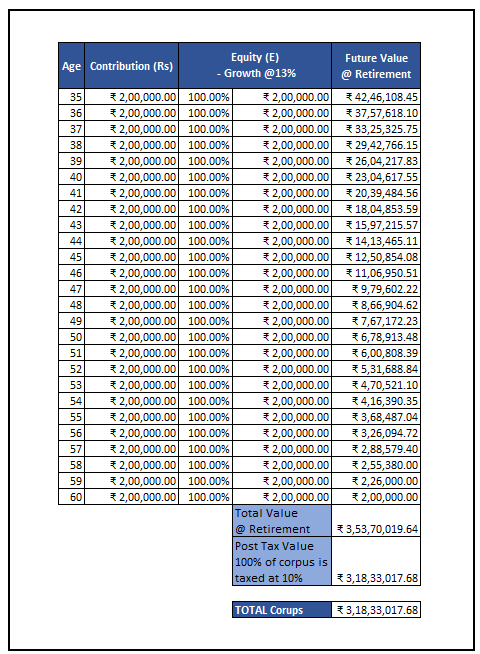

When One check the Index Funds return for 10+ years it looks almost similar or slightly superior, it comes to around 13% returns.

1% might look small but when compounded would make a significant difference over a long period of time, this must be dealt in great detail.

What if I opt for Index Mutual Fund instead of NPS ?

Lets do the math to understand how NPS and Index Mutual Fund behave in the long horizon , let us also consider the most hyped tax savings component in NPS as well to get a fairer picture.

Some assumptions i am going with are , One is investing a maximum of Rs. 2.0 Lakhs per year beyond which there is no tax benefits , One choose Aggressive Choice else the returns would be even more mediocre. The Tax saved is booked in as FD which would generate 7% per year and the taxes on interest is deducted leaving us with an yield of 5% per annum.

So one would be left with a corpus of Rs. 2.65 Cr at the time of retirement.

Now let us see what happens to the same money when invested in NIFTY50 Index Mutual Fund .

One would be left with a corpus of Rs.3.18 Cr at the time of retirement.

Conclusion :

In my assessment, even a basic calculation indicates that the returns from NPS are mediocre. Moreover, when compared to index funds, the risk of losing my retirement savings is evident, leading me to conclude that it’s definitely not the right choice for me.

Here’s the Comprehensive List of Our Blogs: Keep it Handy, Share with Friends and Family, Smash that Like Button, and Subscribe to Receive Blog Updates First. Your support fuels our passion for creating insightful content!

Disclaimer: This blog post is intended for informational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a qualified financial professional before making investment decision.