Tariffs and Their Role in Economic Protection

Tariffs are taxes levied on imported goods, designed to increase their prices relative to domestically produced alternatives. Countries impose tariffs primarily to shield local industries from foreign competition, address trade imbalances, and generate government revenue. By making imports costlier, tariffs encourage consumers and businesses to purchase domestic goods, thereby stimulating demand for homegrown products. This protection can help sustain or expand local industries, particularly in sectors like manufacturing, steel, or agriculture, which are vital for national employment. Over time, proponents argue that tariffs may preserve jobs by allowing domestic companies to grow without being undercut by cheaper imports. For instance, tariffs on foreign steel could bolster domestic steel production, creating long-term employment opportunities. However, critics caution that tariffs may also provoke retaliatory measures, raise consumer costs, and disrupt global supply chains. Despite these trade-offs, tariffs remain a strategic tool for governments aiming to prioritise domestic job creation and industrial resilience.

Why Tariffs Spark Short-Term Inflation

Tariffs act as a tax on imports, immediately raising costs for foreign goods. In the short term, businesses often pass these added expenses to consumers, leading to higher prices for items like electronics, clothing, and raw materials. For example, tariffs on steel increase production costs for automakers, which then raise vehicle prices. Additionally, domestic producers may hike prices for locally made goods due to reduced foreign competition or supply chain bottlenecks. Research by the Federal Reserve Bank of Boston estimates a 25% tariff on Canada and Mexico could add 0.5–0.8 percentage points to inflation, while broader tariffs might push prices up 3–5% within 18 months. Though tariffs create a one-time price surge rather than sustained inflation, the immediate ripple effects—combined with potential retaliatory measures—disrupt purchasing power and market stability, intensifying short-term inflationary pressures.

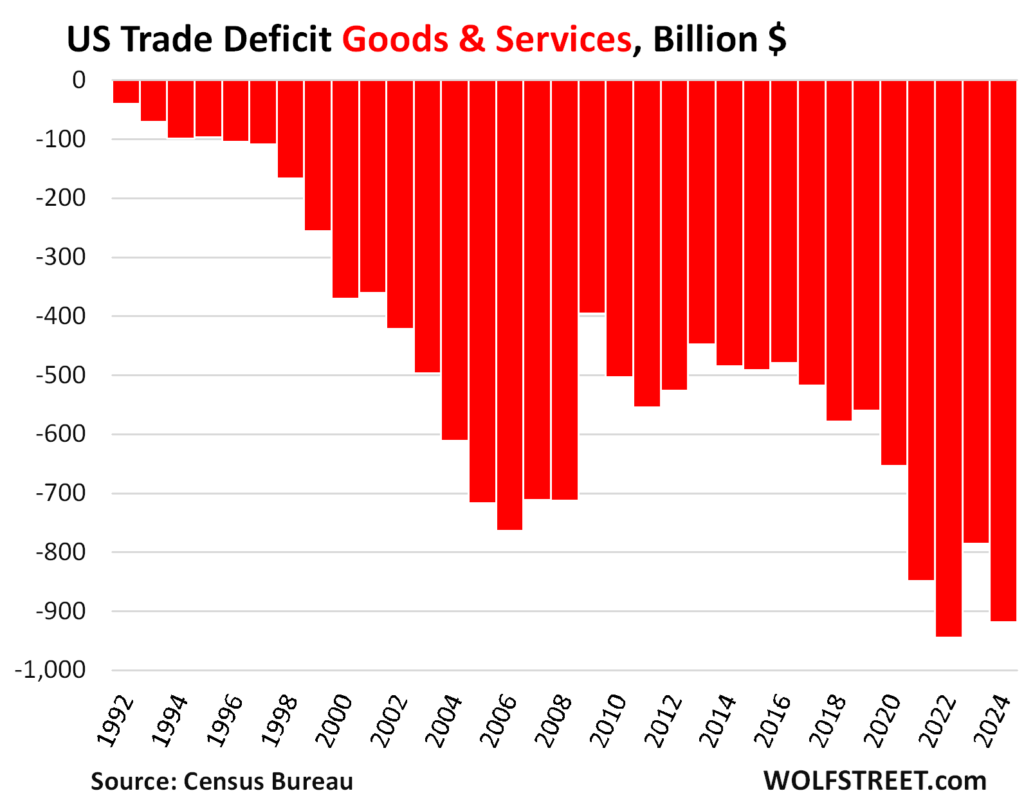

The Dollar’s Dominance and America’s Trade Deficit Dilemma

The U.S. leveraged its position as the issuer of the world’s primary reserve currency—the dollar—to sustain chronic trade deficits with minimal immediate fallout. As the global reserve currency, the dollar is in constant demand for international trade, commodities pricing (like oil), and foreign exchange reserves, allowing the U.S. to borrow cheaply and finance deficits by exporting dollars rather than tangible goods. Post-1971, when Nixon severed the dollar’s link to gold, the U.S. gained unparalleled flexibility to print currency without gold-backed constraints, enabling it to import far more than it exported. Countries like China and Germany accumulated dollar reserves by selling goods to America, reinvesting those dollars into U.S. Treasuries—a cycle that kept borrowing costs low and perpetuated imbalances. Critics argue this “exorbitant privilege” let the U.S. enjoy consumer goods at lower costs while outsourcing inflationary pressures to trading partners. However, this system also eroded domestic manufacturing jobs over decades and drew accusations of “free-riding” on global demand for dollars. While the arrangement bolstered U.S. economic hegemony, rising debt and shifting geopolitical alliances now challenge its sustainability, as nations explore alternatives to reduce dollar dependency.

Trump’s Tariff Strategy: Reshoring Jobs and Reshaping Trade

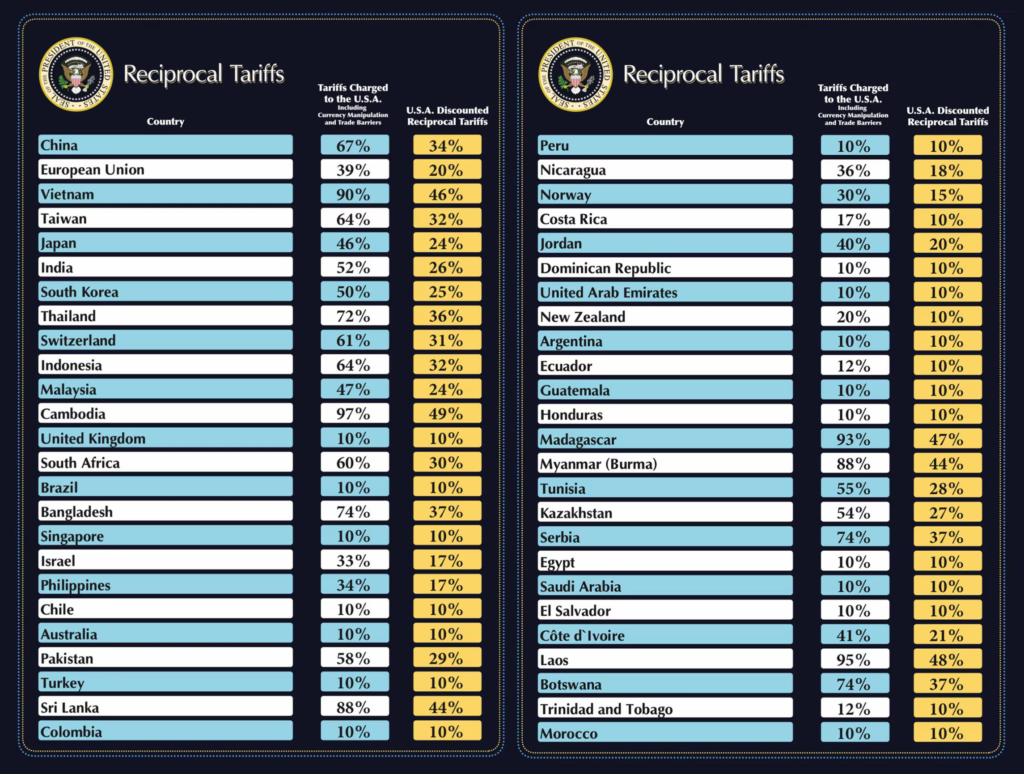

President Trump’s April 2025 tariff announcement—imposing a 10% baseline levy on nearly all imports and reciprocal tariffs up to 46% on key trade partners like China and the EU—aims to reverse decades of “unfair” trade practices, reduce the U.S. trade deficit, and revive domestic manufacturing. Citing the need for “economic independence,” Trump argues these tariffs will pressure companies to relocate production to the U.S., protecting industries like steel, autos, and electronics while creating jobs. Long-term, his administration envisions tariffs as a tool to eliminate income taxes by generating federal revenue through trade levies, alongside fostering industrial self-reliance. However, critics warn of short-term inflation, retaliatory measures (e.g., China’s 34% retaliatory tariff), and supply chain disruptions that could offset job gains and strain global alliances. While Trump points to his first-term tariffs’ success in boosting steel investment, economists caution that sustained protectionism risks recession and market instability.

Erosion of Trust: How U.S. Sanctions Are Undermining Dollar Dominance

The U.S.’s decision to freeze Russia’s $300 billion in foreign reserves and disconnect its banks from the SWIFT payment system in 2022—while crippling to Moscow—sparked global unease over the weaponization of dollar hegemony. Nations like China, India, and Saudi Arabia now fear similar vulnerability, accelerating efforts to diversify reserves into gold, yuan, or bilateral currency swaps to bypass dollar reliance. Meanwhile, European allies grew disillusioned as U.S. sanctions worsened Europe’s energy crisis by restricting Russian oil and gas, with limited American support to offset the economic blow. The Biden administration’s Inflation Reduction Act, prioritizing U.S. green industries over European counterparts, deepened transatlantic distrust. This “dollar weaponization” has fueled de-dollarization trends, with BRICS nations exploring non-dollar trade frameworks and central banks reducing dollar holdings to 58% of reserves (down from 71% in 2000). While the dollar remains dominant, its perceived politicization risks fragmenting the global financial order, as states seek insulation from U.S. unilateralism—a shift that could gradually erode America’s economic leverage and the dollar’s “exorbitant privilege.”

The Future of Finance: A Multipolar Challenge to Dollar Dominance

The U.S. dollar’s global supremacy faces mounting threats as nations and institutions explore alternatives to hedge against geopolitical risks and dollar-driven sanctions. Gold-backed currencies are gaining traction, with central banks like China and Russia stockpiling gold reserves to anchor potential new monetary systems. Meanwhile, the expanded BRICS bloc(now including Iran, UAE, and Ethiopia) is advancing plans for a commodity-backed trade currency, possibly pegged to resources like oil or metals, to bypass the dollar in intra-group transactions. Cryptocurrencies, stablecoins, and central bank digital currencies (CBDCs) add another layer of disruption, enabling cross-border payments without SWIFT or dollar intermediation—El Salvador’s Bitcoin adoption and China’s digital yuan trials exemplify this shift. While a sudden collapse of the dollar is unlikely, these trends could fragment global finance into competing blocs: a dollar sphere, a BRICS-aligned commodity system, and decentralized crypto networks. For the U.S., this risks higher borrowing costs, reduced trade leverage, and inflationary pressures as dollar demand softens. However, transitioning to a multipolar system would face hurdles: BRICS lacks political cohesion, gold lacks scalability, and crypto remains volatile. The dollar’s fate hinges on whether rivals can align economic incentives—and whether America’s debt and polarization accelerate its decline.

Limited Short-Term Pain: Why India’s Tariff Exposure May Be Manageable

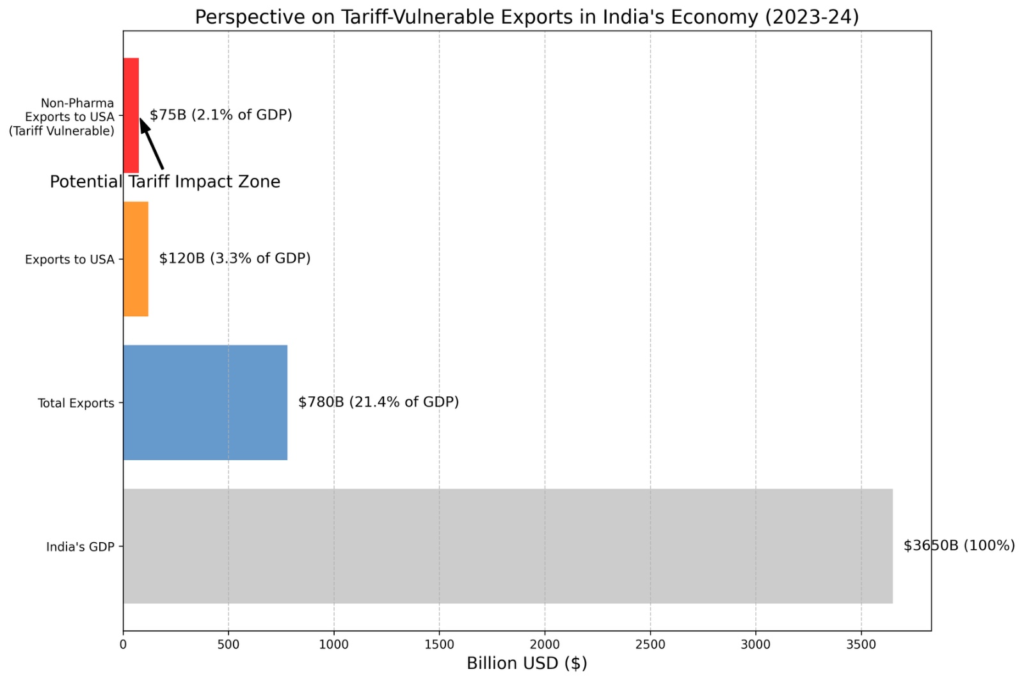

A reciprocal 26% U.S. tariff on select Indian exports—primarily non-pharmaceutical goods like textiles, chemicals, and machinery—would directly impact only a narrow segment of India’s economy. Non-pharma goods exports to the U.S. account for roughly 2% of India’s GDP (around $75 billion annually), with tariffs likely affecting a fraction of this value. Crucially, India’s economy is far less trade-dependent than peers like Vietnam or Germany, with services exports and domestic consumption driving growth. Moreover, since the U.S. is applying similar tariffs to other nations, India faces no unique disadvantage in competitive sectors like apparel or steel. For instance, Bangladesh and Cambodia also face steep U.S. duties, leveling the playing field. However, small and medium enterprises (SMEs) in labor-intensive sectors could face margin pressures, risking temporary job losses. Yet, India’s strategic focus on trade diversification—deepening ties with the EU, ASEAN, and Africa—and its push for production-linked incentive (PLI) schemes in manufacturing could offset these shocks. In the near term, the limited scale of targeted exports and global parity in tariff burdens suggest India’s economy would absorb the impact without significant disruption.

India’s Tariff-Driven Export Opportunity in Key Sectors

The U.S.’s imposition of higher tariffs on China (34–54%) and Vietnam (46%) compared to India’s 27% has created a competitive window for Indian exports, even in sectors where it previously lagged in efficiency. For instance, India’s solar equipment exports now hold a pricing edge over Chinese counterparts, which face cumulative tariffs up to 79% due to earlier levies. Similarly, textiles and electronics—where Vietnam and Bangladesh face tariffs of 46% and 37%, respectively—could see Indian firms capture market share as global buyers diversify from costlier rivals. While India’s manufacturing efficiency in these sectors may trail competitors, the tariff gap offsets cost disadvantages, enabling exports previously deemed unviable. Reports by GTRI and SBI highlight India’s potential to attract supply chain shifts, particularly in labor-intensive sectors like garments, where China’s dominance is waning. Though short-term challenges persist for SMEs, India’s strategic tariff positioning offers a pathway to expand exports in sectors once dominated by more efficient, now tariff-burdened rivals.

Summary :

The recent U.S. tariff surge under Trump—a mix of economic nationalism and geopolitical brinkmanship—is more than a trade policy shift; it’s a catalyst for a fragmented global economy. As America weaponizes tariffs to reshore jobs and rivals like BRICS challenge dollar dominance with gold, crypto, and commodity-backed currencies, India stands at a crossroads. While short-term tariff pain for India appears manageable (impacting just 2% of GDP), the long-term stakes are higher: Can India leverage tariff gaps to replace China in sectors like solar tech and textiles, despite efficiency gaps? Or will dollar devaluation and retaliatory blocs squeeze its export ambitions? This blog unpacks how Trump’s tariffs, dollar distrust, and India’s strategic bets could reshape its role in a world where trade is no longer just about economics—it’s about survival in a fractured financial order.

Here’s the Comprehensive List of Our Blogs: Keep it Handy, Share with Friends and Family, Smash that Like Button, and Subscribe to Receive Blog Updates First. Your support fuels our passion for creating insightful content!

Disclaimer: This blog post is intended for informational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a qualified financial professional before making investment decision.