Unveiling the Art of Stock Investing: Expertise, Dedication, and the Gift of Time

Delving into the world of stock investing requires a blend of expertise, dedication, and a generous investment of time. Firstly, becoming adept at analyzing businesses is akin to becoming a detective. It involves scrutinizing a company’s financial statements – the balance sheet, income statement, and cash flow statement – to understand its health. This financial sleuthing also extends to assessing a company’s growth potential, competitive positioning, and the broader sector trends in which it operates. This expertise doesn’t happen overnight; it’s a continuous learning process.

Dedication is the backbone of successful investing. Monitoring the stock market demands a commitment to staying informed about global and industry-specific news, economic changes, and shifts in market sentiment. Understanding the intricacies of financial markets and developing a keen sense for when to act or hold requires persistent effort.

Time is the unsung hero of the investing journey. Just as Rome wasn’t built in a day, a well-constructed stock portfolio takes time to evolve. Patience is crucial, as markets can be unpredictable in the short term. Regularly reviewing and adjusting your investment strategy, and being prepared for the long haul, is part of the time investment required.

In essence, becoming a savvy stock investor is not just about buying and selling; it’s about honing analytical skills, staying dedicated to the market’s pulse, and giving investments the time they need to flourish. This trio of expertise, dedication, and time is the winning combination for those navigating the exciting yet complex world of stock investing.

A great way to start this journey is here.

Simplicity in Diversity: The Effortless Journey of Investing in Mutual Funds

Investing in mutual funds offers a straightforward and user-friendly path for those seeking a hands-off approach to building wealth. The process begins with selecting a mutual fund that aligns with your financial goals, time horizon, and risk tolerance. Unlike scrutinizing individual stocks, this involves evaluating the fund’s historical performance, expense ratio, and the expertise of the fund manager. Effort is considerably reduced as you’re essentially placing your trust in the hands of experienced professionals who manage the fund’s portfolio.

Once the choice is made, purchasing mutual fund shares is a breeze, often just a few clicks away through an online platform or with the assistance of a financial advisor. The beauty of mutual funds lies in their inherent diversification – your investment is spread across a variety of assets, reducing the impact of a poor-performing individual investment.

Tracking a mutual fund is simpler compared to managing a portfolio of individual stocks. Regular updates on the fund’s performance are readily available, allowing investors to gauge how well it aligns with their objectives. The fund manager takes on the responsibility of adjusting the portfolio to maximize returns within the fund’s defined strategy.

Selling mutual fund shares is also uncomplicated. Investors can redeem their shares at the current net asset value (NAV), providing liquidity and flexibility. The exit decision is often tied to changes in your financial goals, time horizon, or risk tolerance.

The icing on the cake is having an experienced fund manager at the helm, making tactical decisions on behalf of investors. Despite the expertise involved, mutual funds typically charge a modest management fee, allowing investors to benefit from professional management while keeping costs reasonable. In essence, investing in mutual funds offers a hassle-free experience, combining the simplicity of the process with the expertise of a seasoned fund manager to navigate the financial markets on your behalf.

You can read more about Mutual Funds here and then here

Why I choose Direct Stock Investing over Mutual Funds and why I don’t blindly recommend my approach for all ?

Certainly! Here’s a refined version of your idea with improved grammar, sentence formation, and spelling:

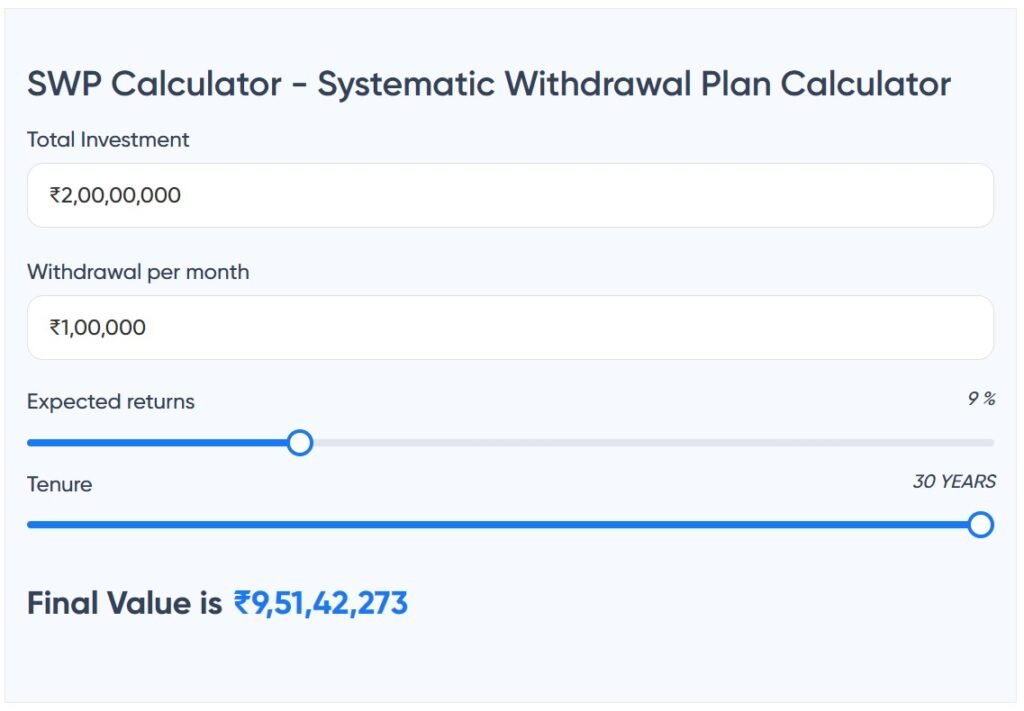

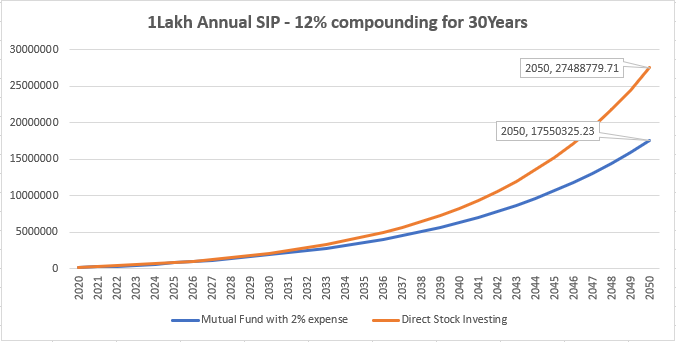

Upon analyzing the financial landscape, a compelling argument surfaces in the realm of investment strategies. Consider a scenario where one invests directly in stocks, allocating 1 lakh per year for 30 years, with an assumed annual growth rate of 12%. The outcome is a substantial 2.7 Crores at the end of the period. Contrastingly, envision investing in a mutual fund, maneuvering through various funds while maintaining the same growth rate of 12%. However, factor in the 2% annual toll for entry criteria, expense ratio, and exit load to the mutual fund house. The result? A take-home amount of 1.7 Crores, marking a staggering loss of over 1 Crore, translating to nearly a 30% deficit.

While one might argue that transaction frequency might be lower or the charges could be less than the stipulated 2%, the counterargument asserts that diligent analysis can potentially yield more substantial returns in direct stock investing. The crux of the debate lies in the significance of a 30% surplus post 30 years versus the present commitment of time and effort required for understanding, investing, and tracking.

For individuals like me who are coming from a lower-middle-class background, the prospect of 30% additional funds after three decades holds paramount importance. It not only secures financial stability but also offers a competitive advantage. The time spent from in-depth financial analysis can be redirected towards self-improvement in diverse areas such as economics, geopolitics, resource optimization, and leadership skills. This multifaceted skill set can contribute to career growth, potentially leading to increased income. With the newfound financial flexibility, one could even enhance their SIP contributions over the years, generating substantial returns upon retirement.

However, it’s crucial to acknowledge that this perspective may not resonate universally. Individuals who prioritize present-day time constraints, value simplicity, and are uninterested in delving into the complexities of business analysis may find comfort in the ease of mutual fund investments. The choice between direct stock investments and mutual funds ultimately hinges on personal preferences, financial goals, and the perceived trade-off between immediate convenience and long-term financial gains.

Here’s the Comprehensive List of Our Blogs: Keep it Handy, Share with Friends and Family, Smash that Like Button, and Subscribe to Receive Blog Updates First. Your support fuels our passion for creating insightful content!

Disclaimer: This blog post is intended for informational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a qualified financial professional before making investment decision.