Less Than 1% Of Stock Traders Make More Returns Than An FD Over A 3-Year Period: Zerodha CEO

This is such an important statistic to introspect and think: Is stock market investing your cup of tea? And if it is, are you making these common mistakes that could lead to financial losses?

1. Lack of knowledge and research

Many people invest in stocks without fully understanding how the stock market works or without conducting thorough research on the companies they invest in. This lack of knowledge can lead to poor investment decisions and potential losses. One must truly understand the financials of a company, such as the balance sheet, profit and loss statement, and cash flows. It is crucial to read annual reports and comprehend the company’s objectives before making long-term investments. A single quarter of poor performance should not greatly concern a value investor who maintains a long-term perspective.

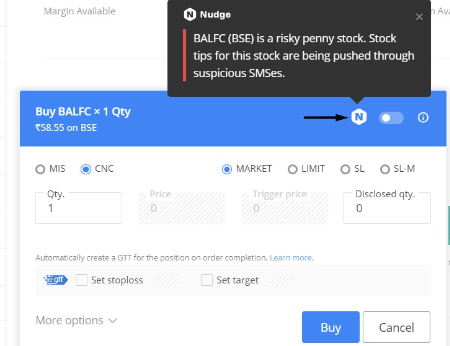

2. Falling to Pump and dump Schemes

People often fall victim to the allure of “Khabar” or the “Heard on Street” (HOS) phenomenon, where they believe they possess exclusive information unknown to others. However, this information is often false or deliberately manipulated. It is a common tactic employed in pump and dump schemes, where scammers invest their money first and then disseminate such rumors through SMS, emails, and other means. Their intention is to artificially inflate the stock’s price, allowing them to silently exit their positions while leaving others unaware. Consequently, individuals end up purchasing stocks at inflated prices, thinking they hold great value, only to witness a rapid decline resembling a falling knife. As a result, substantial financial losses are incurred.

By falling prey to these schemes, individuals unwittingly place themselves in a precarious situation, owning stocks that are significantly overvalued and prone to steep declines. It is crucial for investors to exercise caution, conduct thorough research, and rely on reliable sources of information before making investment decisions. Avoiding the temptation of speculative rumors can help safeguard against significant financial losses.

Read more here.

3.Lack of diversification: Putting all your eggs in one basket.

Imagine an investor named Sandhya. She has a significant portion of her investment portfolio allocated to stocks in the technology sector. Sandhya believes that technology companies have tremendous growth potential and decides to concentrate her investments solely in this sector.

Unfortunately, a sudden market downturn occurs, impacting the technology sector heavily. Due to factors such as regulatory changes or a decline in consumer demand, the technology stocks in Sandhya’s portfolio experience a substantial decline in value. As a result, her investment portfolio suffers significant losses.

On the other hand, let’s consider another investor named Manoj. Manoj recognizes the importance of diversification and allocates his investments across multiple sectors. He spreads his investments across technology, healthcare, consumer goods, and financial services companies.

When the market downturn hits, Manoj’s diversified portfolio is better equipped to weather the storm. Although the technology sector experiences a decline, the losses are offset by gains in other sectors. This helps mitigate the overall impact on Manoj’s investment portfolio, resulting in a smaller decrease in value compared to Sandhya’s concentrated portfolio.

By diversifying her investments, Sandhya could have reduced her vulnerability to losses caused by the decline in the technology sector. Diversification allows investors to spread their risk across different sectors, industries, or asset classes, which helps to safeguard their investments against the potential pitfalls of a single investment or sector.

In summary, the example highlights how a concentrated investment approach can be risky, as it leaves investors more exposed to the performance of a single investment or sector. Diversification, on the other hand, provides a cushion against potential losses by spreading risk across different areas of the market.

4.The Emotional Rollercoaster: How Emotions Influence Investment Decisions

Investing in the financial markets is not just about crunching numbers and analyzing data; it also involves managing emotions. Emotions can have a profound impact on investment decisions, often leading to impulsive actions based on fear or greed. When emotions take the driver’s seat, investors may find themselves buying high during market euphoria or selling low during periods of panic. This emotional rollercoaster ride can have detrimental effects on their portfolios and overall financial well-being.

Fear and greed are two dominant emotions that can drive investment behavior. Fear often emerges during market downturns or economic uncertainties, triggering a desire to protect capital at any cost. This fear-driven response may lead investors to sell their investments hastily, often missing out on potential market recoveries and long-term gains. On the other hand, greed can cloud judgment during times of market exuberance, creating a FOMO (Fear of Missing Out) mentality. Investors driven by greed may be tempted to chase high-flying stocks or speculative assets without conducting proper due diligence, risking substantial losses when the market corrects.

Short-term market fluctuations can also provoke emotional reactions that cloud rational decision-making. Investors may panic-sell when the market dips, driven by a fear of further losses, even though the fundamentals of their investments remain strong. Conversely, when markets rally, investors may get caught up in the exuberance, leading to overconfidence and excessive risk-taking. Emotional decision-making based on short-term market movements can disrupt long-term investment strategies and hinder the potential for sustainable returns.

To navigate the emotional challenges of investing, it is crucial for investors to cultivate discipline, patience, and a long-term perspective. By developing a well-defined investment plan, sticking to a set of predetermined criteria, and avoiding impulsive reactions driven by emotions, investors can increase their chances of making sound investment decisions and achieving their financial goals.

5.The Pitfalls of Market Timing: Why It’s Hard to Predict Short-Term Movements

Attempting to time the market has long been a tempting pursuit for investors seeking quick gains. The allure of buying low and selling high is undeniable, but the reality is that timing the market accurately is an exceptionally challenging task, even for seasoned investors. Predicting short-term market movements with precision is akin to navigating through a complex maze blindfolded. More often than not, those who try to time the market find themselves caught in a web of missed opportunities, lost profits, and potential losses.

Nobel Prize winner William Sharpe found that a market timer must be right a staggering 82 percent of the time to match a buy and hold return.

Stocks need not move for few years and then give huge returns in a single year. Always staying invested is the only way to benefit from these movements. Most of us become impatient and quit thereby foregoing gains.

Here’s the Comprehensive List of Our Blogs: Keep it Handy, Share with Friends and Family, Smash that Like Button, and Subscribe to Receive Blog Updates First. Your support fuels our passion for creating insightful content!

Disclaimer: This blog post is intended for informational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a qualified financial professional before making investment decision.